Link to report:

USDA Top Commercial Lenders for FY2020

Link to raw data:

http://www.rd.usda.gov/sites/default/files/FY2020bligationsLenderReport.pdf

Link to stylized spreadsheet:

To Be posted

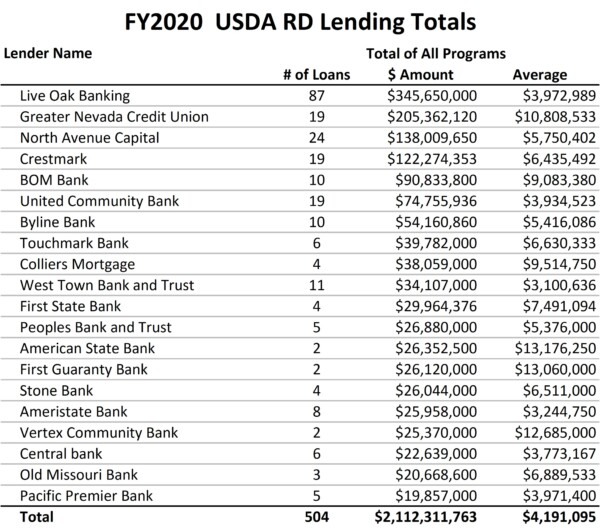

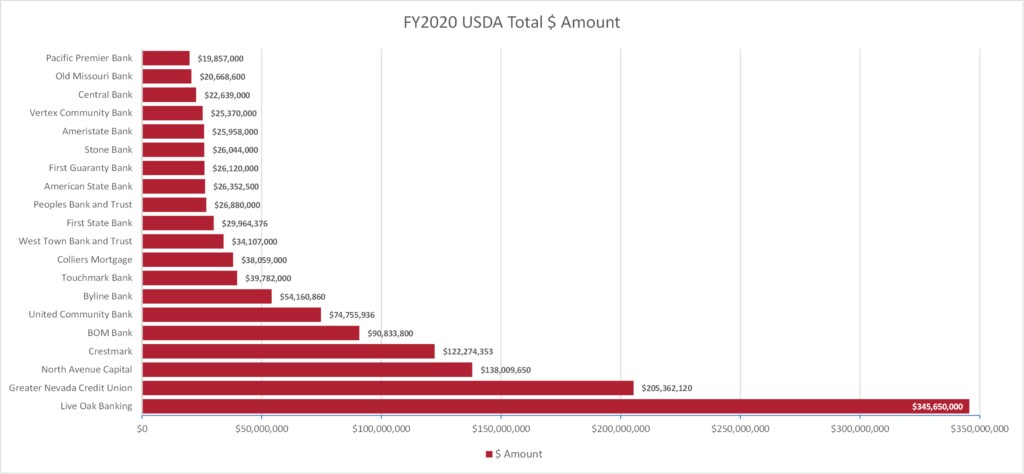

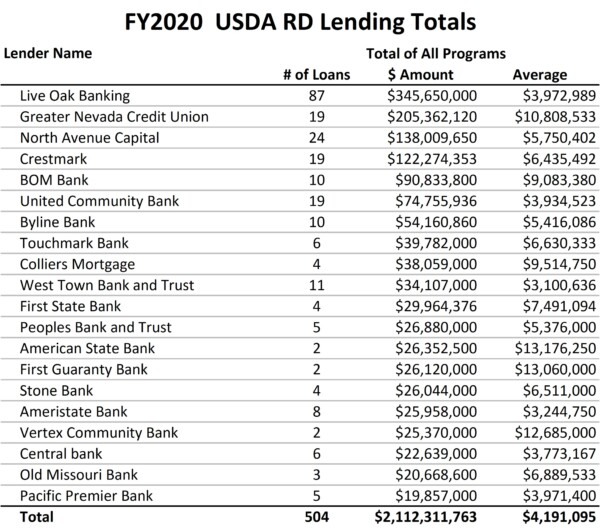

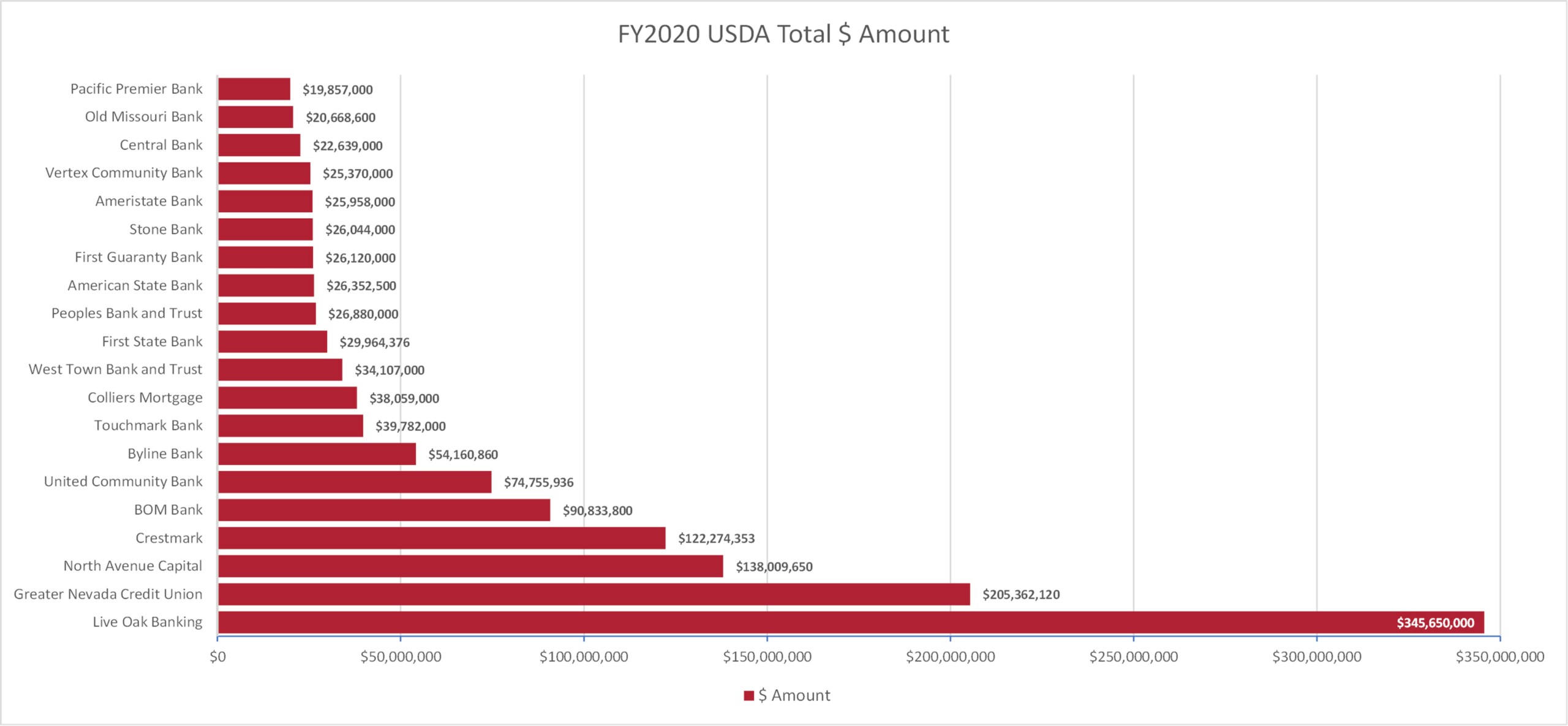

This is an impressive list showing the 181 partner institutions lending more than $2.1 Billion across the five programs tracked by Rural Development, Business & Industry, B&I CARES Act, Rural Energy for American Program, Community Facility, Water and Environmental Programs.

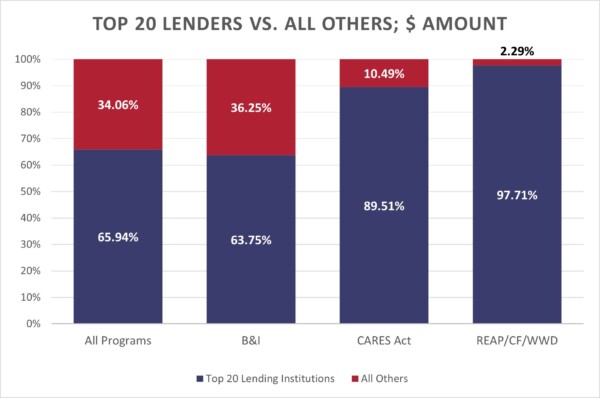

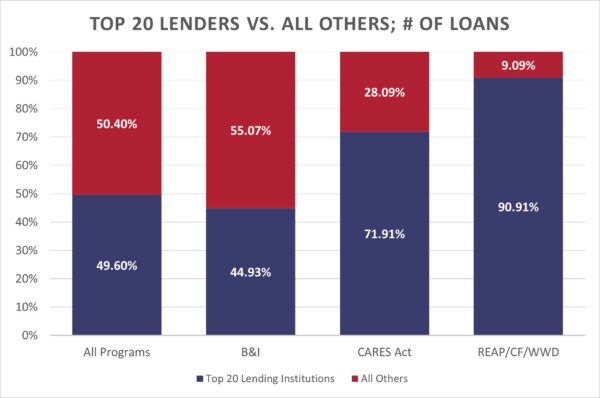

The top 20 lenders throughout all five programs had 250 loans approved for $1,392,848,195, representing 49.60% and 65.94% of the total loans and amount, respectively. With the passing and implementation of RD5001, it will be interesting to see how the average loan size increases given the guaranty rates are now set at a fixed rate for each program and not on a tiered system, like for B&I. Also, with Community Facility decreasing its guaranty from 90% to 80%, I believe funding from this program will fall or rely on direct loans more than guaranteed loans.

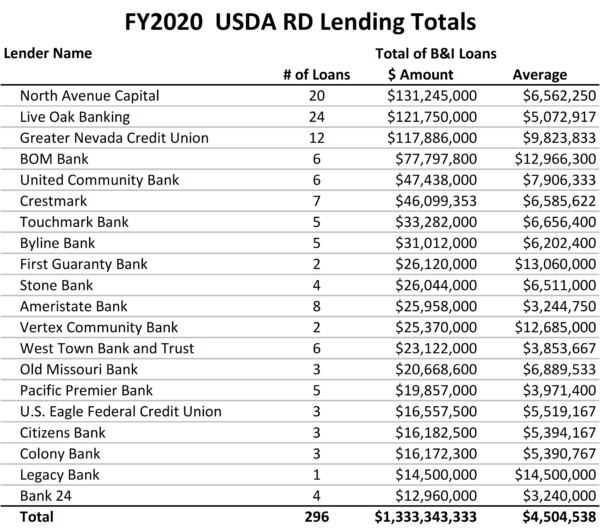

Business and Industry Loan Program

The USDA Business and Industry was the most popular program among lenders with more than 137 different lending institutions completing $1.3 Billion in guaranteed loans on this program. The top 20 lending institutions are shown below and account for more than $850,022,000 in total loans making up 63.75% of the $1,333,343,333 in B&I loans approved in FY2020. The top 20 lenders completed 133 loans on this program making up 44.93% of the total loans approved.

I believe FY21 will see an increase in funding form this program with the changes in Equity Requirements as well as removal of the tiered guaranty based on loan amount. While the number of loans may not increase, I believe the average loan size will increase as lenders take advantage of the 80% guaranty up to the $25,000,000 threshold.

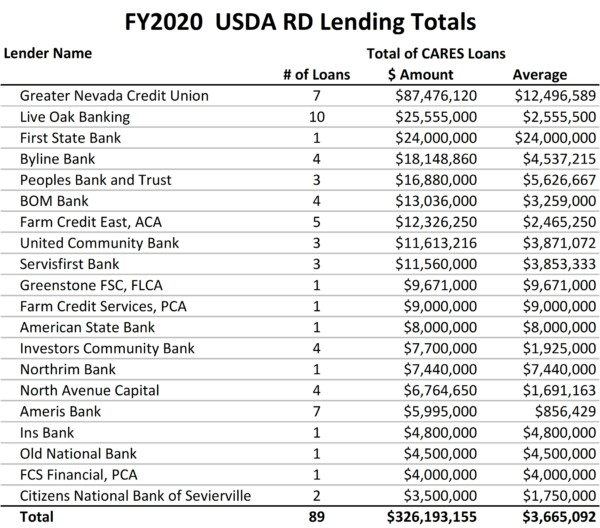

B&I CARES Act Loan Program

The CARES Act loan program was passed into law in the Federal Register in 2020 which allows working capital to qualifying businesses to help with COVID recovery. The program comes with 12 months of principal and interest deferment followed by as much as 24 months of interest only with a total term of 10 years. The loan can be for 1 year of qualifying operating expenses less PPP/EIDL loans taken. For loans less than $1,000,000 a new appraisal is not required however the FDIC has limitations on extension of new debt with stale valuations in file so consult with your compliance officer before completing these loans to ensure you are in compliance with bank regulation.

The list below shows the top 20 lenders in FY2020. In 2020 the total amount borrower through this program was $326,193,155 with more than 89.51% of that amount coming from the top 20 lending institutions, show below. There were 89 loans completed with the top 20 lenders completing 64 of those or 71% of the total. The total allocation for this program is $1,000,000,000 of which 32.6% has been allocated as of 9/30/2020.

Rural Energy for America Program/Community Facility/Wastewater and Environmental Programs

In the release by the USDA these individual programs were broken out separately however due to the volume I have combined them into one graph. The raw and stylized data show them broken out.

In FY2020, there were $324,155,993 in REAP loans made where 11 lenders participated. The overwhelming top lender in this program was Live Oak who completed 45 loans for $183,394,000 while Crestmark completed 12 loans for $76,175,000. Between these two lenders they completed 75% of the total loans and funded 80% of the total.

There were $100,718,100 in Community Facility loans completed in which 17 lenders participated. One lender, Colliers Mortgage completed $38,059,000 over 4 loans representing 38% and 16% of the total loans.

There were $27,901,182 in Wastewater and Environmental loans completed of which there were six lenders, three of which accounted for more than 95% of the total loans in this program.

Links to the Top 20 Lender’s Government Guaranteed Websites

- Live Oak Bank: https://www.liveoakbank.com/small-business-loans/

- Greater Nevada Credit Union: https://www.gncu.org/Greater-Commercial-Lending/Loan-Programs

- North Avenue Capital: https://northavenue.com/services/loan-programs/

- Crestmark: https://www.crestmark.com/industries-solutions/alternative-energy-financing/

- BOM Bank: https://www.bofm.com/mortgage-services/

- United Community Bank: https://www.ucbi.com/business-banking/lending/sba-lending/usda-business-and-industry-lending/

- Byline Bank: https://www.bylinebank.com/small-business-capital/sbc-usda-loans/

- Touchmark Bank: https://www.touchmarknb.com/business/business-lending

- Colliers Mortgage: https://www2.colliers.com/en/services/colliers-mortgage/agency-finance#03a7e2e8-e942-4fcf-a289-b9613a12dc25

- West Town Bank and Trust: https://www.westtownbank.com/business/lending/usda-business-loans/

- First State Bank:

- Peoples Bank and Trust: https://www.bankpbt.com/business-services/business-loans/

- American State Bank: https://www.ambankiowa.com/our-services/loans/

- First Guaranty Bank: https://fgmc.com/

- Stone Bank: https://www.stonebank.com/loans/usda-business/

- Ameristate Bank: https://www.ameristatebank.com/business/business-loans/

- Vertex Community Bank: https://veritexbank.com/business/business-government-loans/business-sba

- Central Bank: https://www.centralbank.net/small-business/loans/

- Old Missouri Bank: https://www.oldmissouribank.com/loans/business-loans/

- Pacific Premier Bank: https://www.ppbi.com/expertise/small-business-sba/usda-business-industrial-b-i-guaranteed-loan-program.html

Leave A Comment